The Importance Of Credit Monitoring Service

By

Easy Tips

—

Tuesday, 17 July 2018

—

Credit Tips

Are you thinking of ways on how you can rebuild your credit, Why not avail of a credit monitoring service, Credit monitoring allows you to control your finances by giving a clear picture of your credit standing all the time. Have you been a victim of identity theft in the past,

If you have credit monitoring this will not just stop identity theft it will actually prevent it from happening. How does credit monitoring prevent and stop theft, Since you are given updates about your credit standing all the time credit keepers make it quicker for you to see any dubious entry.

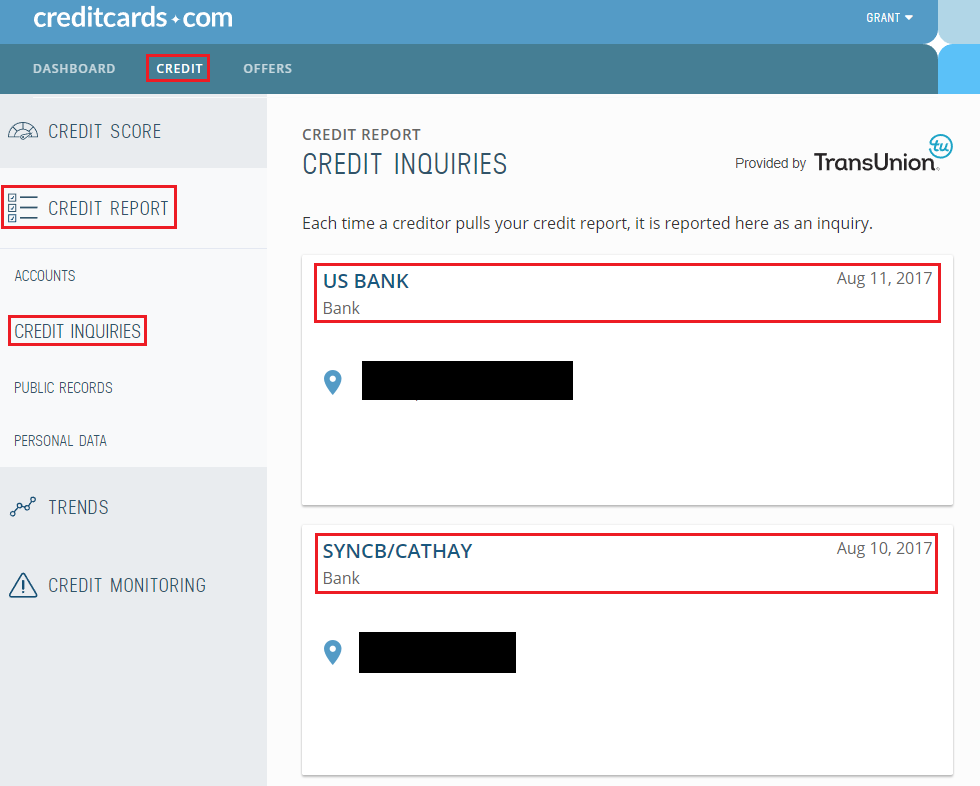

Thus you can request for a credit freeze right away until you can validate the suspicious activity. Moreover, the updates will also inform you who requested for your credit score, what loans or credit was applied for, and where. These are very handy information to trace and stop someone trying to make a victim out of you. Monitoring your debt is an excellent tool in building back your credit standing.

Though these are tough times economically, it is never too late to start sweeping away all the bad credit. Having a tool that will help you keep tabs of your debt is an awesome way to start. With instant access to your credit report you can definitely make adjustments when it comes to your spending. One of the reasons why most people tend to go overboard with their expenses is the inability to keep tab with their spending.

However, with a credit keeper you are given the power to be on top of the situation all the time. The most important benefit of signing up for a credit service is peace of mind. It cannot be denied that having a credit keeper can protect you against scrupulous individuals at the same time you get to fully control your spending. Thus you get to focus on something really important and that is building back your credit rating.

One of the common questions about credit monitoring is "should I subscribe for my credit keeper or go for free service," A free service is good because, well, its free. Thus if you are confident with your credit standing and does not mind the limited information so long as its free then you can sign up with these types of services right away. However, if you want better protection and better control then a paid subscription is definitely the answer.

If your credit report has an extended alert, potential creditors must contact you in person, or by phone or some other method you have provided before they can issue credit in your name. When you place an extended alert on your credit report, you're entitled to two free credit reports from each of the consumer reporting companies within 12 months. In addition, the consumer reporting companies must remove your name from marketing lists for pre-screened offers of credit for five years - unless you ask them to put your name back on the list.

A credit freeze allows you to restrict access to your credit report. If you place a freeze on your report, potential creditors and certain other people or businesses can't get access to it unless you lift the freeze temporarily or permanently. Limiting access to your credit report makes it more difficult for identity thieves to open new accounts in your name. That's because most creditors will need to view a credit file before opening a new account; if they can't see the file, they may not extend the credit.

Still, a credit freeze may not prevent the misuse of your existing accounts or certain other types of identity theft. A credit freeze is different from a fraud alert in a number of ways. A freeze generally stops all access to your credit report, while a fraud alert permits creditors to get your report as long as they take steps to verify your identity.