How To Get A Higher Credit Limit On Your Credit Card

By

Easy Tips

—

Tuesday, 17 July 2018

—

Credit Tips

However a higher credit limit also calls for a higher sense of responsibility, because you can bring bigger debt on yourself. It doesn't mean just because you have a higher credit limit you should spend your credit on everything you see. If you are the type of person who can handle the responsibility of a higher credit limit there are some steps you can take to get one.

A good way to increase the credit limit of your credit card is to ensure that you always follow the terms and conditions of the institution which issued your credit card. This will ensure that you have a good credit rating and will come in handy when you want to raise your limit.

If you can show the issuer of your credit card that you are a responsible person when it comes to money they will find it hard to refuse you. They also know that if they treat you well you may bring other potential clients their way. And as we all know, birds of a feather flock together. So when you are responsible, your friends are likely to be responsible too.

This in turn means that your credit card company would be eager to please you, if you do your part. If you can show the issuer of your credit card that you are a responsible person when it comes to money they will find it hard to refuse you. They also know that if they treat you well you may bring other potential clients their way.

And as we all know, birds of a feather flock together. So when you are responsible, your friends are likely to be responsible too. This in turn means that your credit card company would be eager to please you, if you do your part. Here is one other thing to remember. It is a great thing to have a higher credit limit, but the higher limit may come with higher interest rate payments as well as other fees that may be added.

So although your credit card limit may have been raised, you may now have to pay more, which may mean that you may be left with a little less. But that's a choice you'll have to make for yourself. If you think a higher limit is what you need and you can be responsible with this higher spending power, then, by all means go for it.

The key to a good credit rating is to have a well planned strategy for managing your finance and expenses. Think before you make an impulsive purchase using a credit card and go for surplus expenses only after you have cleared your monthly bills and debt payments. When you borrow more than you can return in time, credit score will take a hit.

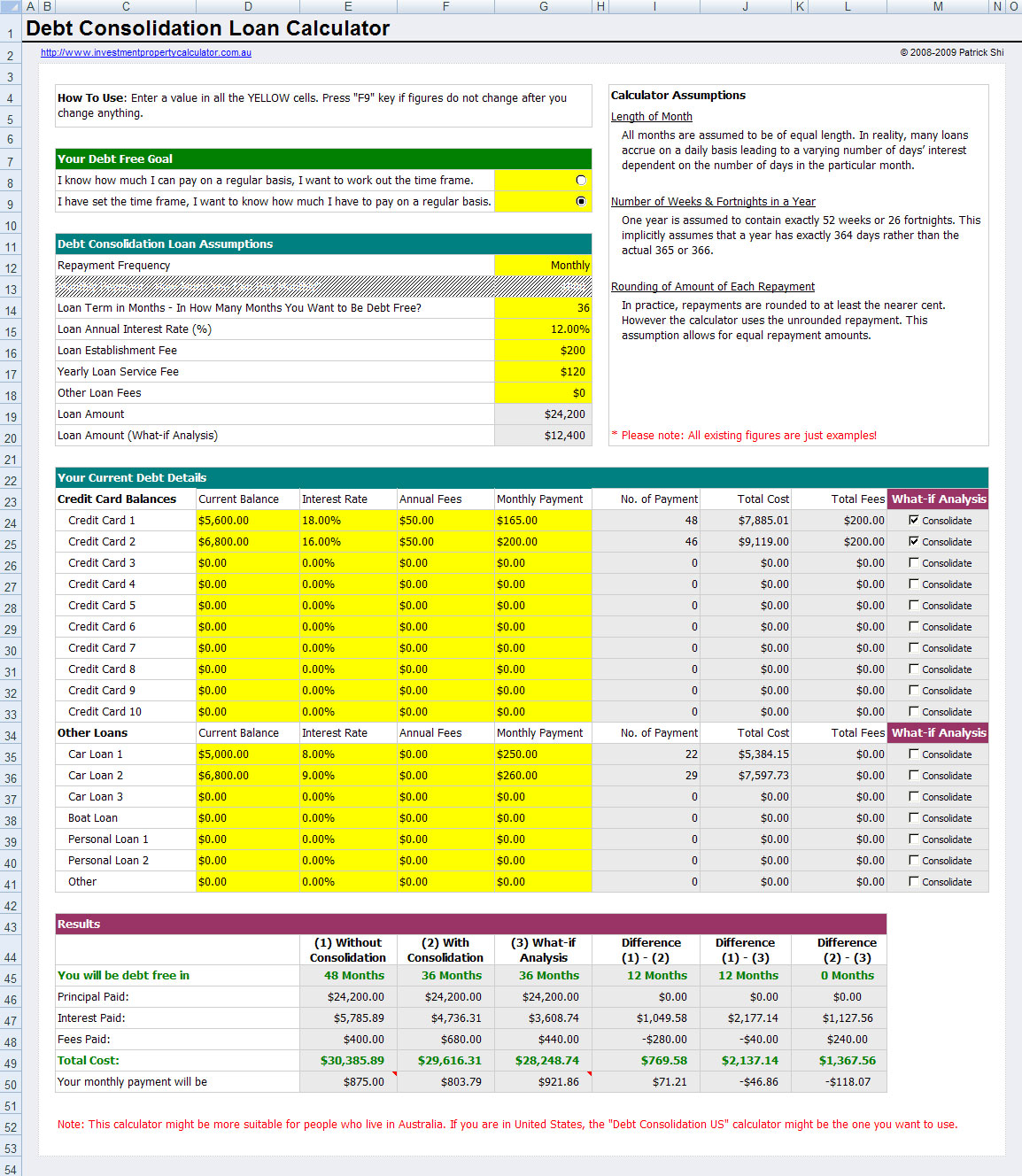

If you are in a situation where the mounting debt is a cause of worry one of the first things that you need to do is, get rid of the credit card debt. Analyze your debt and prioritize the repayment according to the interest rate you are paying on individual debt.

While a chapter 7 bankruptcy will discharge or get rid of many of your debts it comes with severe repercussions. For one thing, you’ll find it very difficult to get new credit in the future. Finally, it’s a mistake to close any credit cards especially those you’ve had for many years. In addition to not being able to use those cards anymore it will have a seriously negative effect on your credit score. There are two reasons for this.