Capital One Venture Benefits And Rewards

By

Easy Tips

—

Saturday, 21 July 2018

—

Credit Tips

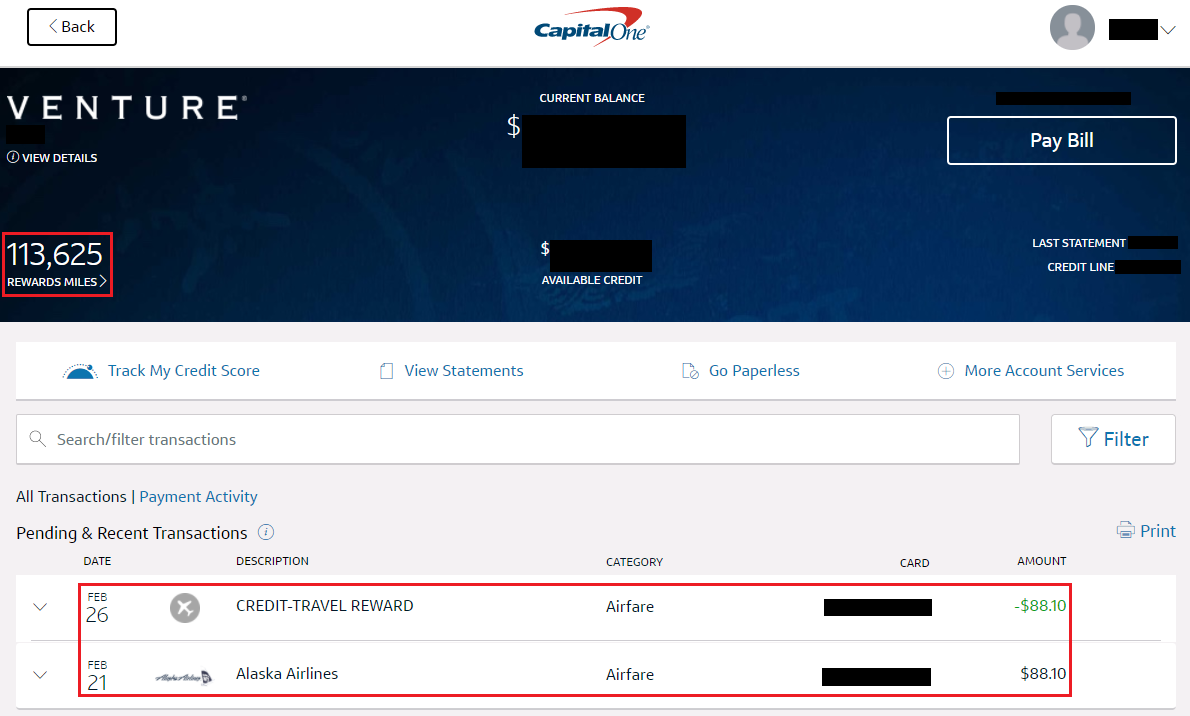

The trade-off for simplicity is that your reward redemption rate will always just be 1 cent per mile. How many Capital One miles do I need for a flight, This depends on the cost of your flight. The redemption value is 1 cent per mile. 300, you will need 30,000 points.

15,000 to earn enough miles for your flight - not including the 50,000-mile bonus promo. To round out our review, we decided to compare the Venture card to some of its competitors. Take a look at how it stacks up against these travel rewards heavy-hitters. Chase Sapphire Preferred: This is a popular card for travelers because of its ability to transfer points to multiple travel partners (including United and Southwest).

Compared to the Capital One Venture card, the Preferred's reward structure isn't as great. You get 2x points on travel and dining and 1x on all other purchases. But the real value is being able to transfer points, which could potentially make each point worth a lot more. 5 or 5% of the amount of each transfer, whichever is greater. 4,000 on purchases in the first 3 months from account opening.

TravelTravel Rewards: Earn 2x miles per dollar on all purchases. Airline Transfer Partners Airline Transfer Partners: Airline transfer partners include United Airlines, Southwest Airlines, British Airways, Air France, Korean Air, Singapore Airlines, Virgin Atlantic, Iberia, and Aer Lingus. Capital One Venture: Pricing information including interest rates, rewards, benefits and fees was obtained on June 28, 2018 from published websites and is believed to be accurate, but not guaranteed.

Disclaimer: The information for the Capital One Venture Rewards Credit Card has been collected independently by CreditDonkey. The card details on this page have not been reviewed or provided by the card issuer. Read our detailed comparison of the two cards. Capital One Quicksilver: Travelers who prefer cash back to miles or points may like the Quicksilver card.

500 in the first 3 months. The Quicksilver card also has no annual fee and no foreign transaction fees. Balance Transfer FeeNo balance transfer fee3% of the amount of each transfer that posts to your account within the first 15 months. 500 on purchases within three months of account opening.

TravelTravel Rewards: Earn 2x miles per dollar on all purchases. Redeem your miles for travel purchases on any airline, hotel, or car rental. Capital One Venture: Pricing information including interest rates, rewards, benefits and fees was obtained on June 28, 2018 from published websites and is believed to be accurate, but not guaranteed. Capital One Quicksilver: Pricing information including interest rates, rewards, benefits and fees was obtained on June 28, 2018 from published websites and is believed to be accurate, but not guaranteed.

Disclaimer: The information for the Capital One Venture Rewards Credit Card and Capital One Quicksilver Cash Rewards Credit Card has been collected independently by CreditDonkey. The card details on this page have not been reviewed or provided by the card issuer. Capital One VentureOne: For a no-annual fee version of this card, look no further than the VentureOne card. It works much the same way as the Capital One Venture, but the rewards are smaller.

You'll get 1.25x miles on all purchases with no limit on how many miles you can earn. TravelTravel Rewards: Earn 2x miles per dollar on all purchases. Redeem your miles for travel purchases on any airline, hotel, or car rental. AirlineAirline Rewards: Earn 2x miles per dollar on all purchasesAirline Rewards: Earn 1.25 miles per dollar on all purchases. Capital One Venture: Pricing information including interest rates, rewards, benefits and fees was obtained on June 28, 2018 from published websites and is believed to be accurate, but not guaranteed.

Capital One VentureOne: Pricing information including interest rates, rewards, benefits and fees was obtained on June 28, 2018 from published websites and is believed to be accurate, but not guaranteed. Disclaimer: The information for the Capital One Venture Rewards Credit Card and Capital One VentureOne Rewards Credit Card has been collected independently by CreditDonkey. The card details on this page have not been reviewed or provided by the card issuer.