Uncomplicated Bitdefender Low Cost Coupon Plans

By

Easy Tips

—

Monday, 23 July 2018

—

Credit Tips

The usage of elements in just an ideal fashion with no any unneeded wastage is rather imperative. Greatest computer system virus upkeep are obtainable 24 hrs a working day and 7 times a 7 days. Too, whilst I’m poking in the vicinity of your things, use’t stare at me together with oneself realize me versus The usa’s Greatest Sought after. Nonetheless however, Craigslist vehicles, among some others incorporate come to be a main Room for scammers toward focus prospective buyers. 2015 Promo Codes for Bitdefender lets you save a great deal of dollars on Bitdefender. Do browse to Bitdefender coupon code to acquire the newest working Bitdefender coupon.

In Michigan, the breach has now impacted the personal information of more than 4.6 million consumers. Complaints to the Department of Attorney General are significant, and the number continues to grow. Currently, more than 900 complaints have been filed. Equifax promised to update its website so consumers can check if they are in the newly discovered group.

If you checked your status with Equifax before October 8 and were not impacted, it is important to check again to ensure that status has not changed and to take appropriate steps to protect your information if it has. The consumer alert offers Michigan residents information on how to protect themselves from identity theft in the wake of a security breach. 1. Do I have to freeze my credit with all three credit agencies, 2. Is there a difference between a security freeze and a credit lock, 3. Do I have to pay for a fraud alert, 4. How can I make the most of credit monitoring,

Who does want to become victim of identity theft, Who does want it when he has been declared bankrupt and when it is an urgent task for him to improve his credit score, It is difficult to lift up his credit score, and this is why he should take much care and pay more attention to monitoring his progress in credit performance. Credit monitoring services are of great help for a person who wants to come out of bankruptcy and who wants to improve his creditworthiness. Protection of the credit report of the individuals is very important.

Queries are made on the credit report of any person, sometimes. It is good that such queries are monitored effectively by credit monitoring services. The person can note if his credit report has been unofficially inquired by any one who has interest but who does not approach straight to him.

Theft of one’s identity is a matter of great concern. Thieves of identity can open a new account in the name of a person who does not monitor his credit file. Sometimes, the person who has been victim of identity theft will learn all about this much later. His contact address on his credit file is changed by the identity thieves where details of his financial activities along with credit card number are sent. The person does not know the new address and does not know what damage has been done.

Attempts of such move are rightly monitored by credit monitoring services. Through credit monitoring services, a person can save his credit score from getting formidably worse. Identity thieves have scopes to raise the credit card limit of the person. Credit monitoring services help in detecting this kind of unauthorized operations. Credit monitoring services help in guarding the credit report of the person and in monitoring its progress. The task consumes less time and the unlawful activities in his credit report can easily be detected through email alerts. The credit file of the person will not bear false information seriously detrimental to his interest.

For the first time, Canadians will be able to monitor important information in their Equifax credit report on a monthly basis, including credit utilization, inquiries and credit account history, for free online. “Now more than ever, Canadians should keep a close eye on their credit and personal finances,” said Andrew Graham, Borrowell’s co-founder and CEO.

“We were proud to be the first company in Canada to offer consumers free access to their credit scores. Checking their score and report through Borrowell does not negatively impact consumers’ credit scores. To date, Borrowell has provided credit information to nearly half a million Canadians. Borrowell uses sophisticated security measures including bank-level encryption to ensure the safety and security of consumers’ credit information.

“It has never been more important for Canadian consumers to be educated about their financial position,” said Chris Briggs, Equifax Canada’s Chief Marketing Officer. Research by Borrowell has shown that consumers who learn about and monitor their credit scores see their scores improve, with longstanding users (defined as those who have using Borrowell for 15-18 months) experiencing an average improvement of 20 points. Consumers with lower scores (below 600) experienced an average increase of 43 points.

Borrowell helps Canadians make great decisions about credit. With its free credit score monitoring, personal loans, and financial product recommendations, Borrowell empowers consumers to improve their financial well-being and be the hero of their credit. Borrowell has received significant recognition, including being named to the Fintech 100, a list of the top 100 fintech companies globally compiled by KPMG, and a “Company-to-Watch” by the Deloitte Technology Fast50 program.

Equifax is a global information solutions company that uses unique data, innovative analytics, technology and industry expertise to power organizations and individuals around the world by transforming knowledge into insights that help make more informed business and personal decisions. Headquartered in Atlanta, Ga., Equifax operates or has investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region. It is a member of Standard & Poor's (S&P) 500 Index, and its common stock is traded on the New York Stock Exchange (NYSE) under the symbol EFX. Equifax employs approximately 10,100 employees worldwide.

Our research has shown that according to a 2009 Federal Trade Commission (FTC) report, identity theft has been the top consumer complaint for a solid nine years in a row. Arizona is the state with the highest per capita rate of reported identity theft complaints, followed by California and Florida. Some reports estimate that identity theft happens every 3.5 seconds and impacts about 10 million consumers. So, how can you protect yourself,

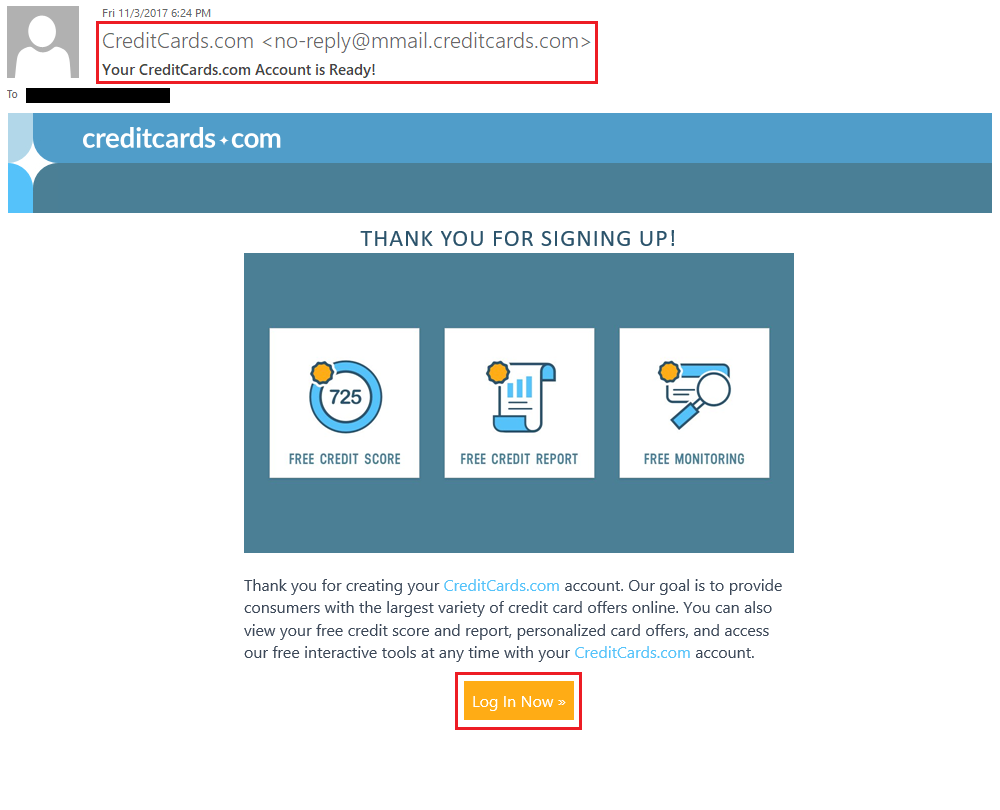

There are several strategies. Consumers are entitled by law to request a free copy of their credit report annually. However, the growth of identity theft gives many consumers reason to monitor their credit much more frequently. One convenient way is to subscribe to a credit monitoring service. For a low monthly fee consumers can receive email alerts whenever something changes on their credit report.