Top Credit Score Equifax

By

Easy Tips

—

Thursday, 19 July 2018

—

Credit Tips

This post is likely to talk of several of the methods Top Credit Score Equifax an individual may build and keep a higher credit history. Looking at this informative article you will need to be capable of specifically how you can fix any credit history issues they will have and find out how to maintain a fantastic score they've already achieved. Credit ratings are not shipped with detailed notes explaining why your distinct score is low. The many insurer knows is there's a recession and many people are suffering.

But it's routine to look at Top Credit Score Equifax the score under consideration. This means it is best to ensure your score is accurate. A survey carried out a years about ago found there was mistakes in almost 80% of credit records. Most errors cant be found significant however you may be one of several unlucky ones. Remember you will find three different credit rating agencies and so they all collect their data from slightly different sources. This forces someone to check the 3. Something is designed for sure, your credit determines Top Credit Score Equifax your lifestyle.

A good credit rating enables you to soar, whereas very poor credit limits you often. Adverse credit can decide your geographical area, which kind of automotive you drive and how you house is furnished. Below-average credit for the enterprise Top Credit Score Equifax means that websites potential is bound. Development may be decided based mostly on your firm's credit worthiness history.

Whether you have good or horrible credit or none whatsoever, its essential to keep yourself well-informed about credit worthiness so that you can handle it effectively. Studying information about finance will advise you the way to improve the quality you could have-style, that's Top Credit Score Equifax what everybody wants. Should you own a enterprise, studying ways to keep away from a bad credit score report is as significant as earning money.

A credit history summarizes your entire credit profile information into one number. This number is calculated by way of a mathematical equation that evaluates many types of information out of your credit score at this particular credit-reporting agency. By comparing this information towards the patterns in 1000s of past credit report, scoring identifies your height of credit risk.

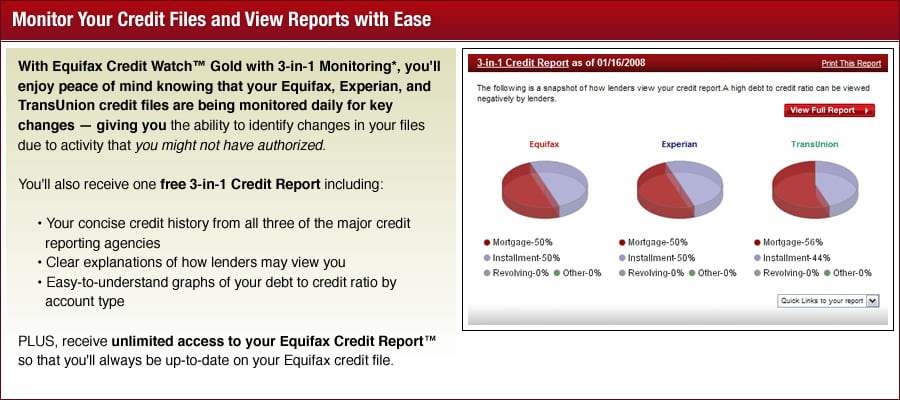

Your score tells a lender how likely you are to settle that loan, or make credit payments by the due date. The higher your score is, better chance you might have of getting the credit are applying for. There, you can get your credit track record from the 3 credit reporting agencies - Experian, Equifax and TransUnion - once every 12 months.

For daily monitoring of one's credit history from every one of the three credit rating agencies, use FastOnlineCreditScores Monitoring. This particular repair makes your individual credit file online 24-7. You've got comfort from realizing that your credit records are now being monitored daily. If any irregular account activity is detected, we'll email you promptly.

Here are 5 places where you can find a free business credit report. Before we dive into where you can find a free business credit report, let’s run through why you’d want to obtain one in the first place. Well, for one, if you’re interested in getting a business loan from a bank or other lenders for your company—or securing business financing down the line—then you should care about your credit history and your current business credit score.

Just as your personal credit score measures your reliability with your personal finances, your business credit score measures your business’s trustworthiness with business finances. If your business credit score shows that your business has a good payment history and is creditworthy (a high Paydex score or FICO score), business lenders will feel more comfortable approving small business loans to you.

Your business credit score isn’t the only factor that determines your loan eligibility, but it’s a major part of your business loan application—especially if you’re applying to banks or more traditional lenders. On top of securing a business loan, a strong business credit score can help you get favorable payment terms from any of your business’s suppliers. When you think about it, this makes a lot of sense. A business credit score essentially shows how reliably a business pays its bills and if you pay off your business credit card.

So having a strong score might convince suppliers to give you more comfortable terms. What Will Your Business Credit Score Look Like, You might be shocked. Before you pull your free business credit report and panic at your low score, know this: Business credit scores are calculated on a different scale. Now that you know the basics of deciphering a business credit report, let’s cover the 6 places you can go to get a free business credit report.

CreditSignal is a free business credit reporting service offered by Dun & Bradstreet—and for a while, it was the only place to get a free business credit report. If you’ve had bad credit in the past, this is a great tool to try out. CreditSignal is a great tool that lets business owners stay on top of their business credit and be alerted when anything changes with their score. Once you sign up, you’ll have an online dashboard or can use a mobile app to monitor what’s going on with your business credit report.

Or, you can choose to receive email alerts whenever anything changes with your score. CreditSignal is not only one of the best (and easiest) places to find a free business credit report, it’s a great place to look for more business credit resources. They offer a business credit education online center to learn about credit information specific to your industry, or receive advice on how to improve your business credit score based on your profile.