Not Following My Argument,

By

Easy Tips

—

Thursday, 26 July 2018

—

Credit Tips

Not following my argument, Think about the amount of data you shared the last time you applied for a financial service, such as a credit card or loan, online. Think about the data you shared last year, while submitting your taxes. Did someone tell you up front that they would take responsibility for any data lost by you during the sign-up process, I didn't think so.

And, chances are, you shared a lot of data during that session - your social security number, your spouse's social security number, your employer, your bank account details, your address - everything on the identity thief's checklist. However, these companies need to do more to protect data during the sign-up process - and during the browsing session as well.

Consumers need to speak out as well. Consumers should insist on using services and technologies like the one that we've developed - Authentium SafeCentral, which uses our patent-pending VERO secure session technology. This kind of technology enables true end-to-end protection for data against key-loggers and screen-capture-based spyware, even if you're just starting out your relationship with a financial service provider.

There is no reason why your provider shouldn't enable this service - we give it to them for free. All of us at Authentium use SafeCentral every day. We wouldn't dream of signing up for a new personal financial management service, credit monitoring service, or bank account, without firing up SafeCentral first.

They’re also required to give notice of significant changes to a card’s terms, so that companies can’t completely alter rewards programs without warning on customers who have been participating for years in a certain rewards program. Be sure you understand a credit card’s terms before you agree to anything — read all the fine print.

But because of the information you’re giving away—especially the last four digits of your Social Security number—you obviously don’t want to trust just any site that offers you a report. Luckily, there are plenty of reputable places that offer you a version of your score, likely including your own bank.

Don’t believe the myth of the single credit score. You actually have hundreds of scores! Most of the free scores you’ll be able to view are your VantageScore. It’s not the same as your FICO score, which is still used by most lenders, but it’s fairly close. Capital One’s CreditWise site, for example, offers the Transunion VantageScore 3.0 to everyone.

The Credit Karma app, which is my favorite for these types of inquiries, offers a VantageScore from both Equifax and Transunion, and NerdWallet’s app also offers your score as well as things you can do to improve it. Your FICO score is updated every 30 days and you can download the reports to compare them to future entries.

American Express, Bank of America, Barclaycard US, Chase, Citi and a few other financial institutions also offer free scores to customers. Finally, Chase’s CreditJourney, Capital One and Credit Karma all offer free credit monitoring as well. To be 100 percent safe you may want to invest in an actual monitoring service or freeze your accounts, but know that these tools will email you if a new account appears on your report. These apps and sites offering free scores won’t be completely accurate—because that’s frankly not possible—but paying attention to the range your score falls in will give you a good idea of where you’ll stand with creditors. If you want to up your score, read more here.

CHARLOTTE, N.C., March 21, 2018 /PRNewswire/ -- LendingTree, the nation's leading online loan marketplace, today announced the launch of a free credit monitoring service within the My LendingTree platform. In partnership with TransUnion, LendingTree monitors users' credit profiles daily and sends alerts of any changes or potential suspicious activity within 30 minutes of the credit report being updated. Inaccurate information on credit profiles can impact credit scores, and with millions of Americans affected by data breaches every year, it's important to act quickly on unauthorized activities.

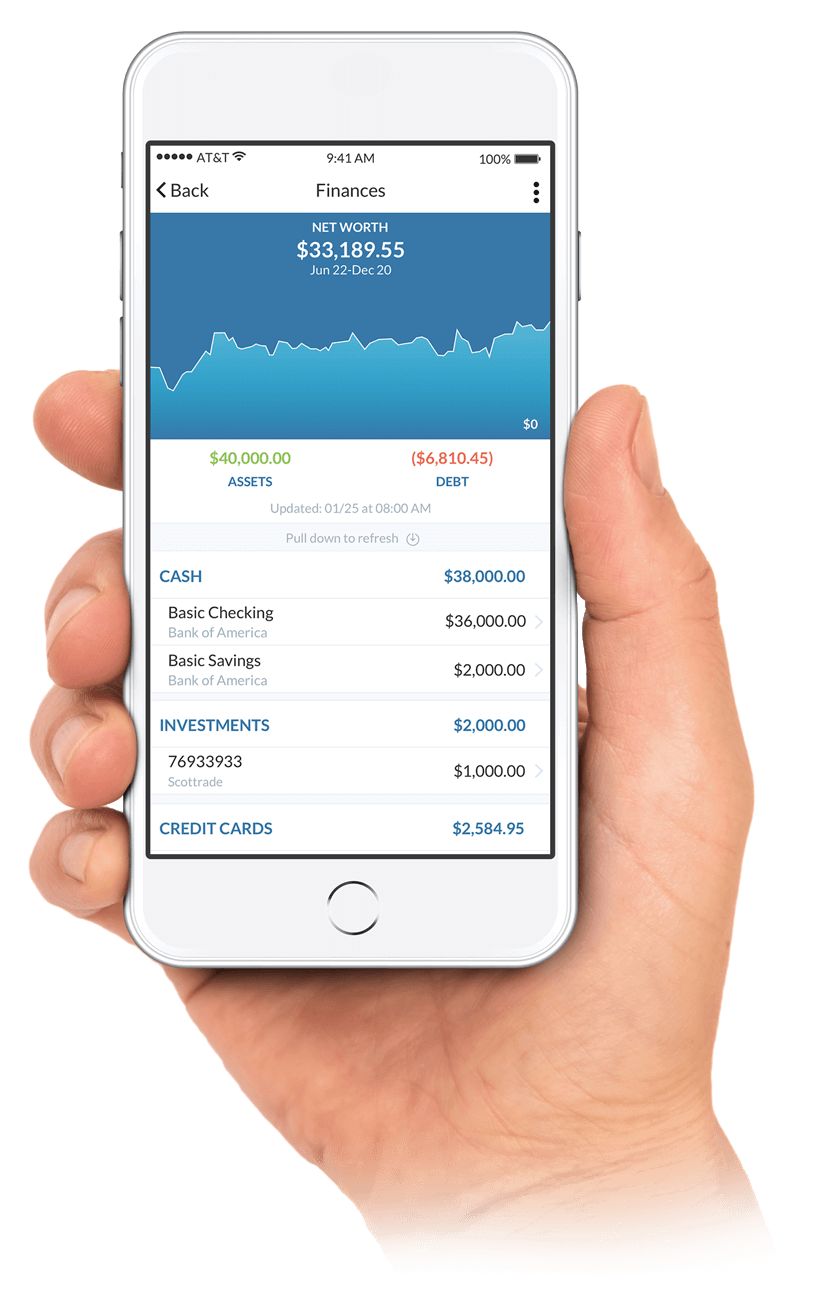

My LendingTree users will receive notifications when changes or suspicious activities are reported in their credit report, including push notifications on their mobile device for users of the LendingTree mobile app. Once logged in, consumers can confirm or dispute changes and activities on their credit report like new accounts, credit inquiries, delinquencies, account status changes, and more. Charles Battle, Senior Director of Product Management. Launched in June 2014, My LendingTree is LendingTree's financial intelligence platform that allows users to monitor their credit health and identifies potential savings opportunities.