Don't Sweat Small Changes In Your Credit Score

By

Easy Tips

—

Tuesday, 17 July 2018

—

Credit Tips

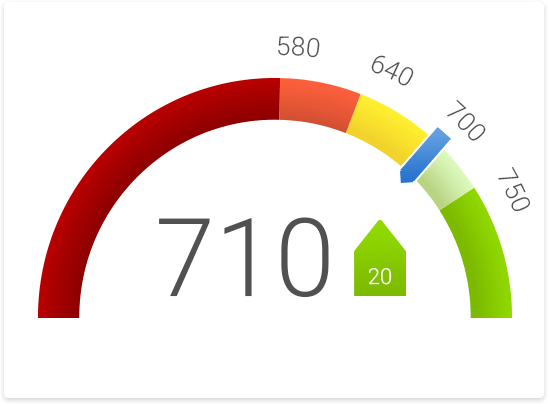

He advises people to stop worrying about minor changes in credit scores. “There’s a natural migration to your scores, normally 20 to 25 points month over month,” he says. A credit freeze doesn’t hurt your credit scores, says Ulzheimer. “Security freezes simply restrict access to your credit reports to existing creditors” plus a handful of other parties such as government agencies and collection agencies, he says.

Also, paying off an auto loan doesn’t cause a score to drop, Ulzheimer says. But, he points out, it isn’t likely to help your scores, either, because installment debt has only a small impact on your scores. Nearly 30% of your FICO score (the credit score most lenders use) is based on amounts you owe. Keep an eye on your credit utilization ratio, which is the percentage of available revolving-account credit you’re using. For more information about credit scores, see How Your Credit Score Is Calculated and MyFico’s credit basics page. Ask Kim at askkim@kiplinger.com.

Universal default punishes consumers and has the potential to ruin credit history and credit scores. There is help on the horizon. Lawmakers are responding to consumer groups who oppose such practices. In June of 2006, New York became the first state to outlaw the practice of universal default. This issue has also gained attention on the federal level. Recently, Democratic Rep. Keith Ellison of Minnesota introduced a bill to the House which seeks to protect consumers from universal default clauses.

Rep. Ellisons Universal Default Reform Act of 2007 would prohibit credit card companies from raising interest rates on consumers based upon payment histories with other credit card companies, utility companies and other lenders. Rep. Ellison has a series of legislative proposals he plans to introduce as part of his consumer justice agenda. His Reform Act has the backing of many consumer groups. In the meantime, monitor your credit card statements, make it a practice to read the fine print on all credit card applications and most of all, stay informed.

Your credit score is almost everything! Without a good score, you may be limited in life as far as your purchase power, and buying the things you want including cars, homes, travel, and that all powerful plasma television! Learn tips and scoring criteria that may boost you to financial freedom.

You can actually save money with a solid good credit score. What are Credit Scores, A credit score is a number that is calculated based on your credit history to aid lenders in determining your credit-worthiness. This number is intended to help a lender ascertain the level of risk they may be taking in loaning you money.

The system awards points based on information in your credit report. Lenders can predict how likely someone is to repay a loan and make payments on time. What Can I Do to Improve My Score, To get the best credit score, you need a mix of different credit types including revolving accounts (credit cards, lines of credit) and installment accounts (auto loans, personal loans, mortgages). Reduce your balances on credit cards to 75% or less of your available credit. Don't charge more than you can pay off in a month.

You don't have to pay interest on a credit card to get a good credit score, and it's a smart financial habit to pay off your credit cards in full each month. Pay your bills on time. This is probably the most important of all! If you don't already have established credit or you need to rebuild, get a secured credit card.

Secured credit cards report your credit payment history information to the credit bureaus just like a regular credit card. They are "secured" by your money. Check with your personal banker. Avoiding over-inquiriesThere are two types of credit inquiries that can be made to your credit report: hard inquiries and soft inquiries.

A hard inquiry occurs when you seek to obtain credit. This happens when you apply for a loan or credit card, for example. Each time you fill out a credit card application at a department store, the inquiry counts as a hard inquiry. Only you can authorize a creditor to perform a hard inquiry on your credit report. A prospective lender or other creditor will likely be concerned with an applicant whose credit report shows a high volume of hard inquiries.

That's because it suggests a carefree attitude in applying for credit or an effort to borrow excessively. Borrowing too much -- a situation called over-leveraging -- is a potential red flag for creditors. It signals you may face more difficulty in repaying your debts in cash-strapped times than a person who judiciously applies for credit.

If you're going to ping your credit report with frequent hard inquiries, it may be best to concentrate them around the time you apply for a home or auto loan. If you're thinking about applying for a mortgage loan, please contact me for advice and information before starting. A soft inquiry is one where the inquiry is not tallied on your credit report. A soft inquiry does not constitute a bona fide request for credit.

For example, a soft inquiry occurs when you obtain a copy of your report. There is no fast and easy way to repair damaged credit that took months or years to occur. The law allows negative information to appear on an individual's credit record from seven to 10 years. Get a copy of your credit report. If you are being turned down for credit you need to be sure the reason is valid. Many credit reports have errors. Dispute any inaccuracies you find. Get a credit report from all three bureaus. Each one may have different information and maybe errors in your file. You can't know which bureau's data will be used to evaluate your credit application, so check them all.

There are a lot of ways to get your credit scores and credit reports and a lot of credit report monitoring services out there. The reality is that most of them are the same services repackaged by different companies. NextAdvisor.com's editors have researched and tried all of them. We've created the below comparison and reviews for only the services that we have found offer the best features and information at the best price. We selected these credit report monitoring services because each of them offers something valuable at a better price than you can find elsewhere.