Credit Sense- FREE Credit Score & Credit Monitoring

By

Easy Tips

—

Saturday, 14 July 2018

—

Credit Tips

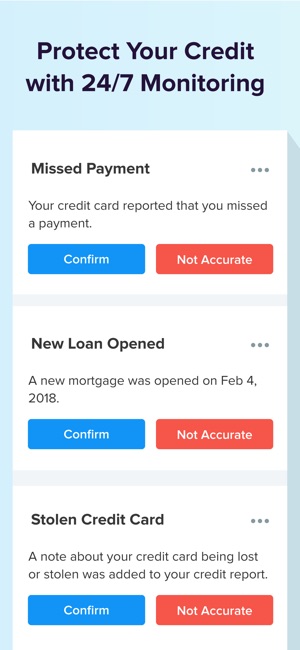

Staying informed of your current financial picture with constant credit monitoring can help you prepare for the future! Within Credit Sense you have the ability to set up alerts to help you with credit monitoring to stay on top of changes to your credit report! Another huge benefit of your membership with KEMBA Credit Union!

Access to Credit Sense is available for MyBranch and MyMobile users. Once you’re logged in to MyBranch click on the “What is your Credit Score, ” image on the Overview page or go to the “Self Service” tab and click “Credit Score”. Once you’re logged in to MyMobile scroll to the bottom of the accounts overview screen and tap on “My Credit Score”. Once you’re in, verify your identity and you’re off!

There are hundreds of articles and tips in Credit Sense. They are there to help you meet your financial goals! You”’ find updated articles every month on topics relevant to you and your financial goals! We’re here to help! We also offer a FREE credit review service where you can sit down or consult with a KEMBA Advisor over the phone about your credit, understanding your score and the items that are on your report.

In the aftermath of the Equifax data breach, announced in September 2017, more people may be considering their identity theft protection options. After all, the credit monitoring agency says the personal information of approximately 143 million U.S. And that information includes consumers’ names, Social Security numbers, birth dates, and addresses—data that could be used by thieves to steal the victims’ identities. As part of its breach response, Equifax is offering consumers one year of a free service that includes credit file monitoring and others services.

Keep in mind that once your personal information is breached, identity thieves may wait a year or more before using or selling it. You may want to consider additional services to help protect your identity beyond that free offer. In the wake of such a large breach, some consumers may decide not to wait for their identities to be stolen before considering a credit freeze to, essentially, lock their credit.

As noted earlier, this type of freeze may involve fees. They may also require some advance planning to "thaw" them if you need to open a new credit account or apply for a mortgage or other type of loan. Keep this in mind if you decide to go this route.

Another option is a fraud alert, which tells potential lenders to verify the identity of anyone opening an account in your name. They’re free, but must be reinstated every 90 days in most cases. Also, note that neither a credit freeze nor a fraud alert will prevent all forms of identity theft—there are plenty of types that do not require a credit check. Also, credit freezes and alerts won’t prevent someone who gains access to your existing accounts from fraudulent activity.

Identity theft protection vs. The bottom line is that if a company offers you free credit monitoring or identity theft protection and restoration services, it probably won’t hurt to take advantage of it. But that alone usually lasts one or two years and actual services may vary. Also, depending on the company you sign up with, you might be seeing credit alerts from only one of the three credit reporting agencies.

So, what’s the best choice for you—paying for identity theft protection or credit monitoring, or taking the DIY approach with credit monitoring, It depends. Credit monitoring services may not be enough to help protect your identity, and monitoring your credit on your own could miss certain threats to your identity. Identity theft protection services may even help you restore your identity, should you become a victim.

Some people who are less familiar with credit may ask, “What’s my credit score go to do with anything”, Well, a credit score determines someone’s risk factor when applying for a loan, credit card, or mortgage. A credit score can range anywhere for 300 to 850. Of course, a 300 credit score is very bad and an 850 credit score is perfect.

There are many ways that someone can find out their credit score. Contacting a credit reporting agency would be one of the ways to find out a credit score. There are a few credit reporting agencies that can be contacted and each one will provide a similar, but different credit score than the others. Each one has a little bit of a different way of determining a credit score.

Everyone should know their own credit score. A credit score plays a huge factor in determining whether or not one can be approved for credit. Having bad credit means that most likely a loan will get denied. It can be a very long, hard process trying to fix bad credit. If someone is a victim of identity theft, that can also take a long time to get resolved. One of the most important things to remember is to always make loan and credit card payments on time.