Credit Card Debt Solutions

By

Easy Tips

—

Monday, 16 July 2018

—

Credit Tips

Many people see this as some kind of reset mechanism, where they could erase their debts and start getting a new chance to use their credit card wisely. Other people see it as an opportunity to not only settle their debt, but also get the peace of mind and a reduction in personal stress.

If you are one of those people who run into the problem of credit card debt, the first step of making the debt settlement process work for you is to admit that you cannot resolve the problem on your own. Until you are ready to let someone guide you out of this problem, you will continue with this ordeal day after day.

However, if you surround yourself with experts that are willing to help you in every way that they can, you would be on your way to settling your debt and resolving other problems that may arise from it. There are two ways in which you could get credit card debt solutions.

One approach is by using a consumer credit counseling service, while another is by looking for a professional who is trained in consumer law. You might want to be careful with the consumer credit counseling services, as they are sometimes run by the same companies that you are indebted to.

Getting a third party that is interested in the effective ways of dealing with your debt is crucial if you want to succeed in your settlement. You should always make it a point that you have complete faith in the professional that you choose to let undertake your debt settlement.

Choosing your advisor by checking their background and references will help you find the best professional to help you. Aside from getting professionals to help you, there are other things that you could do to help in the settlement of your debt. One of the things that you can do is to not make the situation any worse by spending on your card.

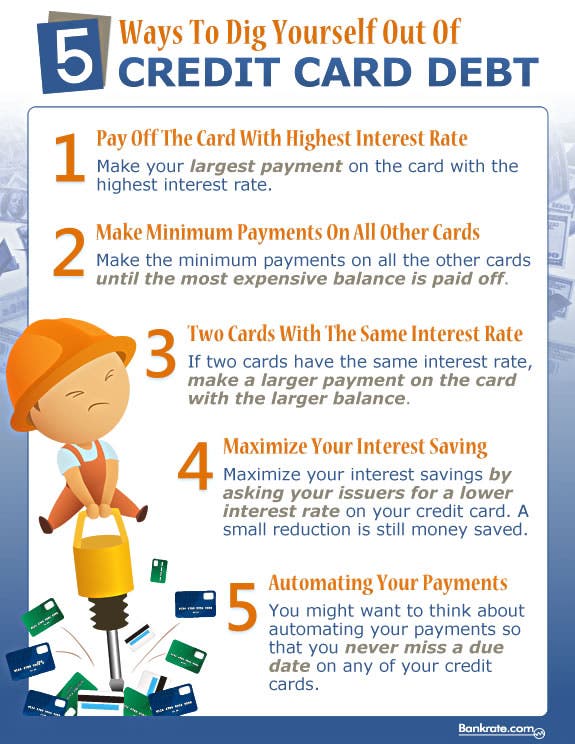

Try to make it difficult for you to gain access to your card unless it is truly and emergency. This way, you would no longer have the impulse to get your card and go shopping. Another thing that you should do to help with your credit card debt solutions is to get yourself a list of your debts, interest rates, and the monthly payments due. This way, you can get to decide which debts you should prioritize and which you can afford to pay. It is all up to you to decide on how you are going to pay your debts. You can then go on and no longer worry about the things that you would need to pay up.

Most of them are sold. And the investors that buy them want to make money while minimizing their risk. First, there is the risk of default. That means that the home owner can no longer meet the debt payments and defaults on the mortgage. If that happens, the investor stands to lose money.

Second, however, is a very different risk -- the risk of pre-payment. This means that the home owner prepays the mortgage, which saves him or her a lot of interest, interest that the investor won't get. And 36% of gross income is a substantial amount of money. In the 1950s, they would think you were on the brink of disaster if you had total debt in excess of 25% of your total monthly income.

In fact, during the fifties, much higher down payments were the norm (up to 50% or more). Now, the trend is to borrow as much as we can while still being able to make the payments. This is a system that's designed to keep us in debt forever. We've all seen where that can get us.

But we don't have to keep playing that game. I believe it's time to rewrite the rules -- to free up money so we can create wealth for ourselves. Just because the bank allows us 36% of indebtedness doesn't mean we have to actually BE that much in debt. We can lower that ratio -- the lower the better -- and whatever we don't have to pay to creditors, we can pay to ourselves and invest for our own financial futures.

How best to do that, Get a plan. Increase your income and pay off the debt. Keep track of your progress, and give yourself a big pat on the back as your debt-to-income ratio goes down month after month -- and your investments go up. About The Author P. Christopher Music began his financial planning career in 1992 in Columbus, Ohio.